Budget

This fact sheet explores the Australian Government’s annual statement of how it plans to collect and spend money.

What will I learn?

- The Budget explains how the government plans to collect and spend money.

- The Budget needs to be approved by the Australian Parliament.

What is the Budget?

How the federal government raises and spends money.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivs 3.0 Unported License.

You are free to share – to copy, distribute and transmit the work.

Attribution – you must attribute the work in the manner specified by the author or licensor (but not in any way that suggests that they endorse you or your use of the work).

Non-commercial – you may not use this work for commercial purposes.

No derivative works – you may not alter, transform, or build upon this work.

Waiver – any of the above conditions can be waived if you get permission from the copyright holder.

The Budget is the Australian Government’s plan for collecting and spending money. Money is mainly collected through taxes and is used to pay for federal government services and responsibilities, such as welfare and the defence force.

The Budget is made up of a collection of financial documents. The main documents explain:

- the government’s assessment of the national economy

- the government’s priorities for the coming year

- how much money the government plans to be collected and from who

- how the government plans to spend this money.

Budget bills

Section 83 of the Australian Constitution says the Australian Parliament must approve the spending of money.

The Budget is a collection of bills – proposed laws – called appropriation bills. allow the government to appropriate – collect and spend – public money.

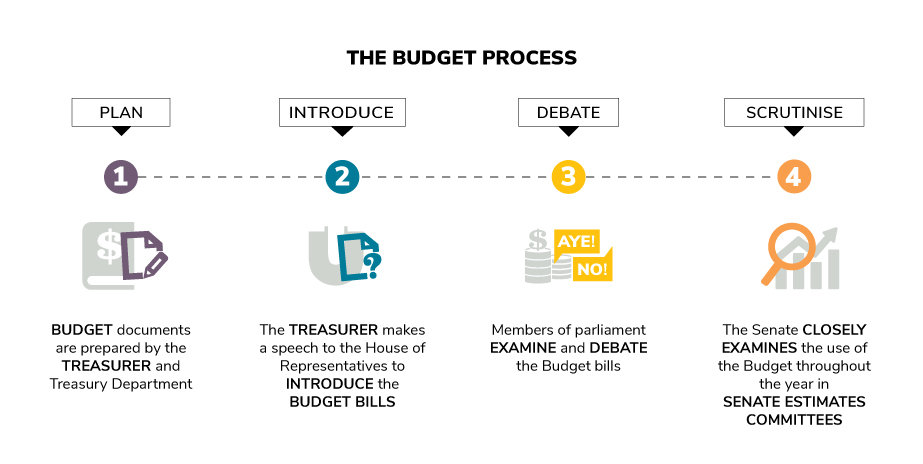

The Budget documents are prepared by the Treasurer with the Treasury Department. Work begins early each year with the Treasurer working with other ministers to develop budgets for each government department. Cabinet – the Prime Minister and other senior ministers – approve the Budget before it is introduced into Parliament.

The government collects money from several sources, including:

- taxes on incomes – people’s wages – , business profits and the sale of items (GST – Goods and Services Tax)

- excise and duties – fees on the sale of some items

- charges such as the Medicare levy

- public – government owned – company profits

- selling government assets.

The government spends money on several areas, including:

- welfare – payments to Australians

- Medicare and aged care

- payments to states, territories and local governments

- universities

- the Australian defence forces.

The Budget speech

The Treasurer gives their Budget speech to the House of Representatives at least once a year, usually in May. This speech is seen as the government’s most important economic statement. It sets out the government’s plans such as increasing expenditure – funding – for particular services, announcing new projects, changes to how money is collected and savings made.

The opposition is given the opportunity to read the Budget and respond a few days later with a speech in Parliament called the Budget reply speech.

Examination of the Budget

Members of parliament scrutinise – closely examine – and debate the Budget bills in the same way as other bills. This is also done through Senate estimates committees. Ministers and senior public servants appear before these committees to explain how government departments have collected and spent public money. This usually happens 3 times a year.

The Parliamentary Budget Office also provides a way for members of parliament and the public to examine the spending of government. It prepares a report after each federal election that shows the financial impact of the major parties’ election promises.

Federal Budget process.

Parliamentary Education Office (peo.gov.au)

Description

This diagram illustrates the development and operation of the Budget. Budget documents are prepared by the Treasurer and introduced through a speech to the House of Representatives. Members of parliament examine the Budget bills. The Senate examines the use of the Budget throughout the year in Senate estimates committees.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivs 3.0 Unported License.

You are free to share – to copy, distribute and transmit the work.

Attribution – you must attribute the work in the manner specified by the author or licensor (but not in any way that suggests that they endorse you or your use of the work).

Non-commercial – you may not use this work for commercial purposes.

No derivative works – you may not alter, transform, or build upon this work.

Waiver – any of the above conditions can be waived if you get permission from the copyright holder.